- Put criteria: You will need to help save a minimum deposit of 5% to 10% to own an excellent ?100,000 mortgage. How much cash it contour might possibly be depends on the worth of the house, however, a beneficial ten% deposit on a beneficial ?100,000 home is ?ten,000. An easy way so you can save money will be to put upwards a savings account and set a percentage of monthly wage, to ten to fifteen%, to the account per month.

- Downloading and optimising the credit history. Before applying it’s important to check your credit history to make certain no less than perfect credit facts occur and take away any incorrect or outdated pointers which could impede your odds of protecting brand new financial you desire.

- Gathering the called for documentation required for the application: The broker can assist you from software procedure and all sorts of the common files expected proof income, about three months out-of financial statements, private ID, evidence of target, evidence of deposit, most recent P60 setting etcetera.

- Finding the optimum bank offering the most useful cost. Their broker will save you a lot of time and, probably, some cash from the distinguishing the loan loan providers currently providing the very competitive rates along the market.

- At the rear of your from the process: Providing a mortgage will be difficult, especially if this is your first application. The best mortgage broker makes it possible to with any circumstances you can get face in the process, look after their passions and become a good lifeline however if anything goes wrong.

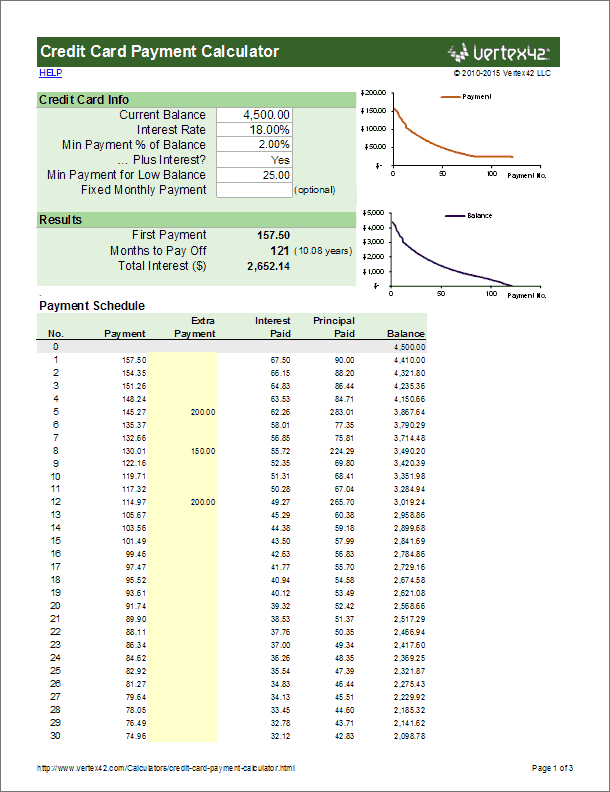

Below are some situations to give a concept of just what your payments might possibly be getting a mortgage that it proportions, and to illustrate how different aspects namely the interest rate and you will term can change new monthly rates.

To have notice-just mortgage loans, the fresh fees stays as well as regardless of the title. Thus, such, the fresh payment revealed to possess six% ?five hundred monthly certainly are the exact same if you selected a great fifteen-season label otherwise a 30-12 months label due to the fact financial support owed doesn’t reduce and that’s paid regarding in full in the bottom playing with an alternative cost car.

For the purpose of this dining table, i imagine the interest rate remains a similar into complete amount of the mortgage. Rates of interest can transform if you remortgage on to yet another rate or change from a predetermined or deal price onto the lender’s standard adjustable rates (SVR).

Factors that affect month-to-month payments

Here are some of your trick standards that could features an impact both actually and you will indirectly on your own home loan repayments:

Interest rates

The pace your safe will influence the monthly rates. Everything else being the exact same, a high rate of interest would mean you only pay even more having good ?100k mortgage month-to-month. This new pricing obtainable can vary. Thus, it is important to manage a loan provider that will offer the very competitive speed to suit your circumstances.

Repaired otherwise Tracker

You’ll also have the choice to choose anywhere between a predetermined speed versus a great tracker financial. Usually, a fixed rates could well be large, boosting your month-to-month cost. But, locking when you look at the a speed can allow one to most useful package your cash.

Label Size

The length of time you’re taking aside home financing for could affect your pricing and you will really perception your month-to-month rates to have good ?100k mortgage. A lengthier name will most likely decrease your loans in Crossville without credit check month-to-month payments, nevertheless results in using furthermore the life span of mortgage.

Your age

In the event you can rating a home loan at the whatever many years, go out in your favor can lead to most useful purchases away from lenders. This may suggest lower costs and you can month-to-month money to suit your ?100,000 home loan.