The first tips to buying a home will always many problematic – no sense and you can restricted knowledge, first-home buyers will certainly end up in barriers which may haunt all of them throughout the procedure.

In a digital globe, home buyers tend to trust what you they can supply which have an effective click, such that they disregard that there exists real anybody aside here instance mortgage brokers that will finest help them go their desires.

Home loans are experts who bring financial suggestions to those planning to shop for property. They book these consumers from intricacies from home-loan application, that’s becoming strict now because of the stricter credit guidelines enforced by finance companies.

If you’re first-home buyers at this time can get answers to their questions having an effective quick search on Bing, it’s still very informed so they can search the assistance from a mortgage broker to assist them browse the house-loan processes inside the real life. Here you will find the reasons to consider calling a large financial company:

One of several steps you have to online personal loans NV just take when buying a good house is making certain that your financial wellness is within check. Taking out financing is a huge financial commitment, therefore it is necessary for you to definitely safe your money earliest. This really is among the first something lenders will help your having.

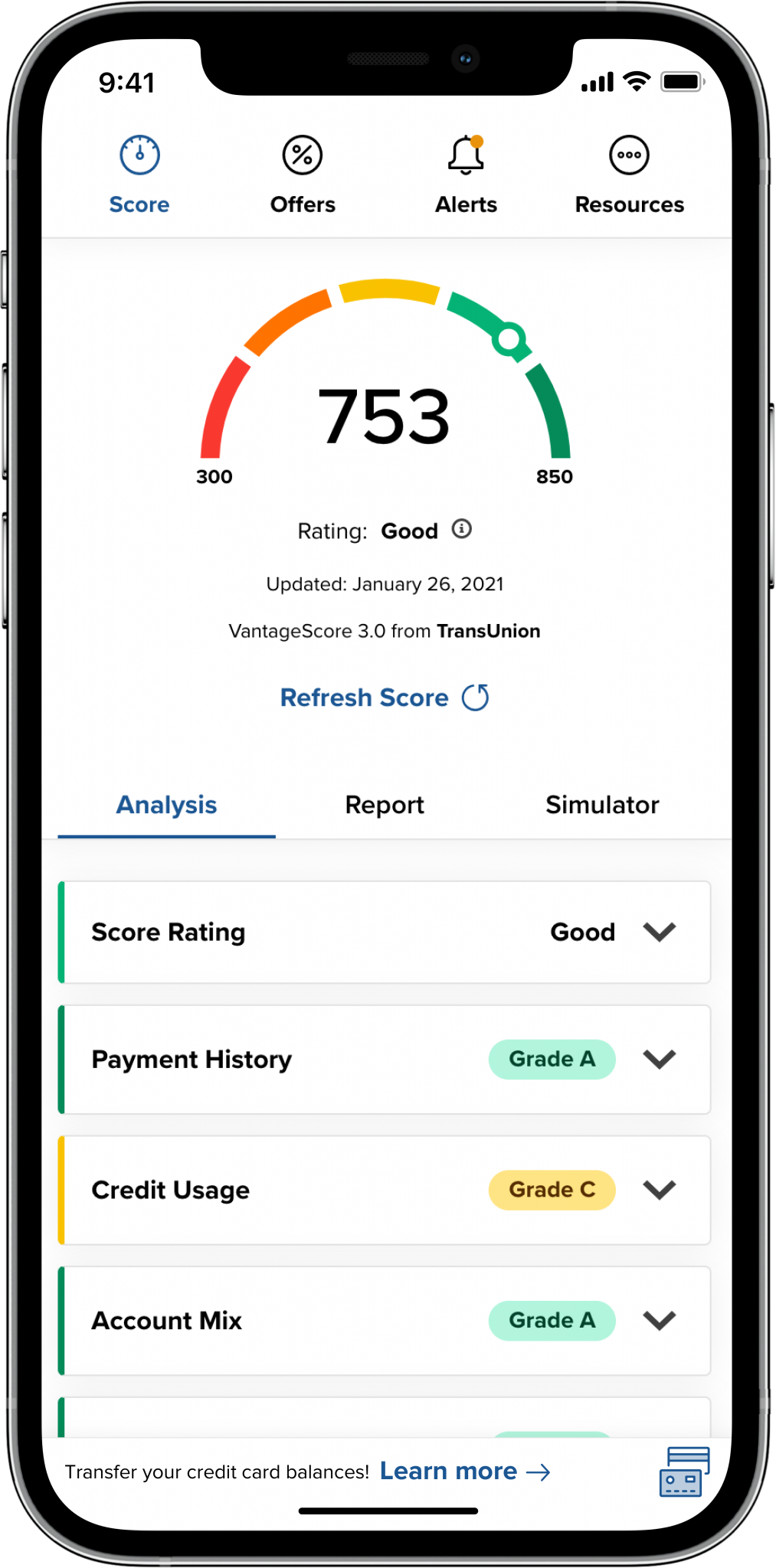

Contacting an agent is a smart circulate for those who need to change your chances of having your family-application for the loan recognized. They may be able leave you a sense of the borrowing-worthiness according to your credit rating, sources of income, expenses, and you will existence.

Brokers possess learned how loan providers assess house-loan requests, going for new knowledge to assist basic-home buyers manoeuvre the fresh new rigorous procedure making an application for a mortgage can get include.

Brokers may also be helpful you have made a good pre-approval, that’s very important in the securing a house on deals. They could help you decide which lenders be much more suitable for your circumstances and you may financial prospective, so it’s easy for you to definitely clinch a property-financing pre-recognition.

step one. Indicating that you could pay for a mortgage

First of all, what the loan providers need to see is your trustworthiness. Your credit rating represents the trustworthiness since the a borrower. To ensure your credit rating was at a perfect height, your own broker you’ll advise you to settle almost every other obligations towards the big date. Be quick inside the paying your utilities and you may cellular phone bills while making sure that your stick to most readily useful of one’s mastercard repayments. Your financial will see you just like the a promising candidate in case the credit history is really as pristine to – zero overlooked or late repayments.

dos. Proving you have a stable source of income

Next thing your lender would want to get a hold of once you sign up for a home loan can be your a position balances. For many who get in touch with lenders, they most likely suggest that you amuse financial you can take to a career. Generally, loan providers will require its individuals to get no less than 6 months within their most recent condition.

If you are a personal-operating, part-date, or informal employee, the method becomes a bit trickier, since you have to prove you to definitely what you are getting are stable adequate to manage servicing a loan. A mortgage broker will help very first-big date homebuyers to get the proper financial and also the most readily useful home-loan device for your situation.

3. Examining your residence-loan application files to possess problems

The prospective here’s excellence – one to small mistake is also slow down your application process for several days. A small correction will be enough for the mortgage app to get the new thumbs-off.