2.) Regulators Applications to own Down-payment

(DPAP): First-big date homebuyers can apply for that loan as much as 5% of your own price of a property. The utmost mortgage was $twenty five,000.

Manitoba Housing Down payment Advice: This method even offers advance payment assistance to qualified applicants selecting to order a vacant house belonging to Manitoba Casing inside find outlying components or even to most recent renters looking getting the home it are presently leasing out-of Manitoba Construction.

PEI Deposit Assistance System: Eligible consumers can use to receive an attraction-totally free loan as much as 5% of one’s purchase price of a home, so you can a total of $17,500. The mortgage have to go towards the down-payment to your home.

Area for Waterloo Reasonable Home ownership Program: This method provides lowest- in order to moderate-income properties having advance payment recommendations fund of five% of purchase price (restrict $480,000) regarding an eligible household.

Condition away from Simcoe Homeownership System: This option will bring doing 10% deposit assistance paid back within closing with the lawyer within the trust.

And also have to put less cash upon home financing is take a look tempting, there are certain things to take on prior to signing right up having an effective deposit mortgage:

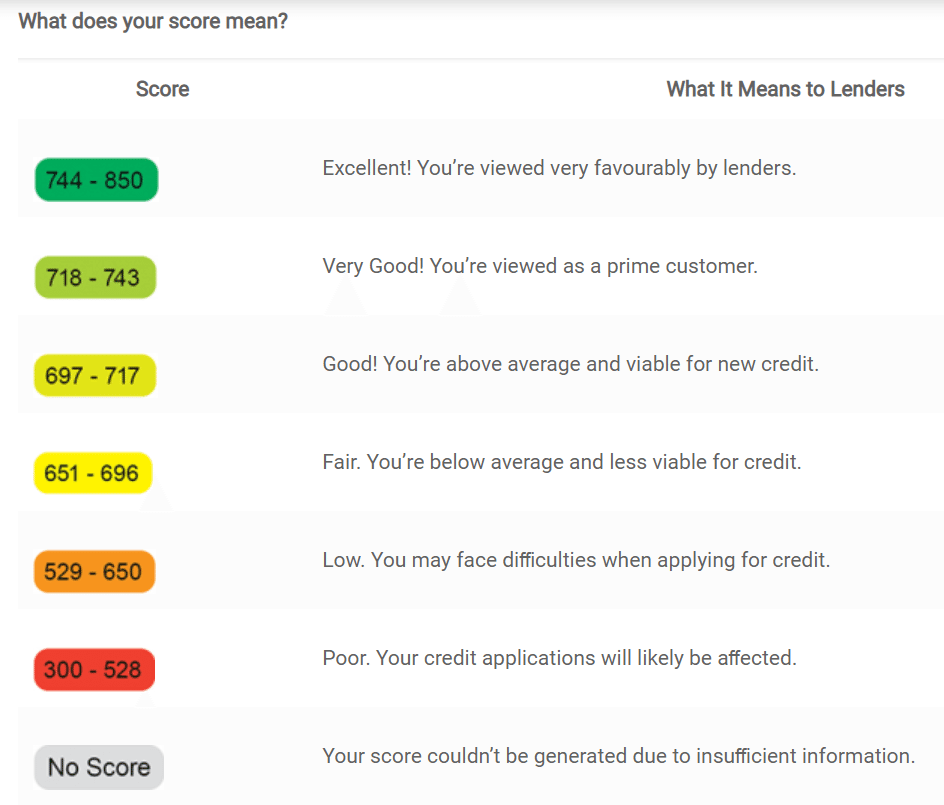

Getting entitled to a curve Down home loan, you ought to have a stable income source, a great credit score, strong credit score and strong debt-to-money proportion

- It’s not necessary to fatigue your Crystal Lake loans hard earned money reserves (or wait until you’ve got stored enough) to possess an enormous deposit.

- You could begin strengthening home collateral ultimately rather than spending money to the lease.

Are qualified to receive a flex Down financial, you should have a stable revenue stream, an excellent credit score, good credit score and solid obligations-to-income ratio

- Also a home loan premium, you may also spend increased interest, based on their credit worthiness.

- You’ll be able to improve full quantity of debt (along with your financial obligation so you’re able to service ratio) given that you’ll currently have each other a home loan and a home loan down percentage loan.

- Your normally you want good credit and you will record to-be eligible.

If you are not wanting (otherwise entitled to) home financing down-payment financing, there are choice an approach to financing the purchase of the first house.

So it federal system offers first-go out homebuyers 5% or ten% of the residence’s cost to place toward an advance payment to reduce the quantity they want to borrow. You nevertheless still need to obtain the minimal 5% advance payment. New due date for new applications and you can resubmissions compared to that system try today . No the new approvals was granted after was discontinued. Discover our very own Feds Garbage Basic-Time Household Customer Incentive System blog post for more information.

In the place of a traditional mortgage, this choice is actually a provided equity home loan between the national (via the CMHC) as well as the house consumer. As a result youre entitled to discovered a specific amount in accordance with the price of your home in addition to type of out-of domestic you are to invest in, we.e. the bonus count for a different sort of home is 5% or 10% and you may a current residence is 5%. This new incentive need to be reduced entirely on business of our home otherwise shortly after 25 years.

With the example of a beneficial $eight hundred,000 family and you may the absolute minimum deposit out of $20,000 (otherwise 5%), you might apply to found $20,000 in the a discussed collateral financial (5% of current domestic speed).

To get qualified to receive a fold Down home loan, you ought to have a constant source of income, a very good credit score, good credit history and solid personal debt-to-earnings proportion

- Their total qualifying income cannot be more $120,000, or $150,000 whether your home youre to acquire is within Toronto, Vancouver otherwise Victoria.

- Their total borrowing from the bank (the loan and system count) can not be more four times the being qualified money (4.5 times if you’re to buy in the Toronto, Vancouver or Victoria).