Another type of example, towards a great $three hundred,000 house

![]()

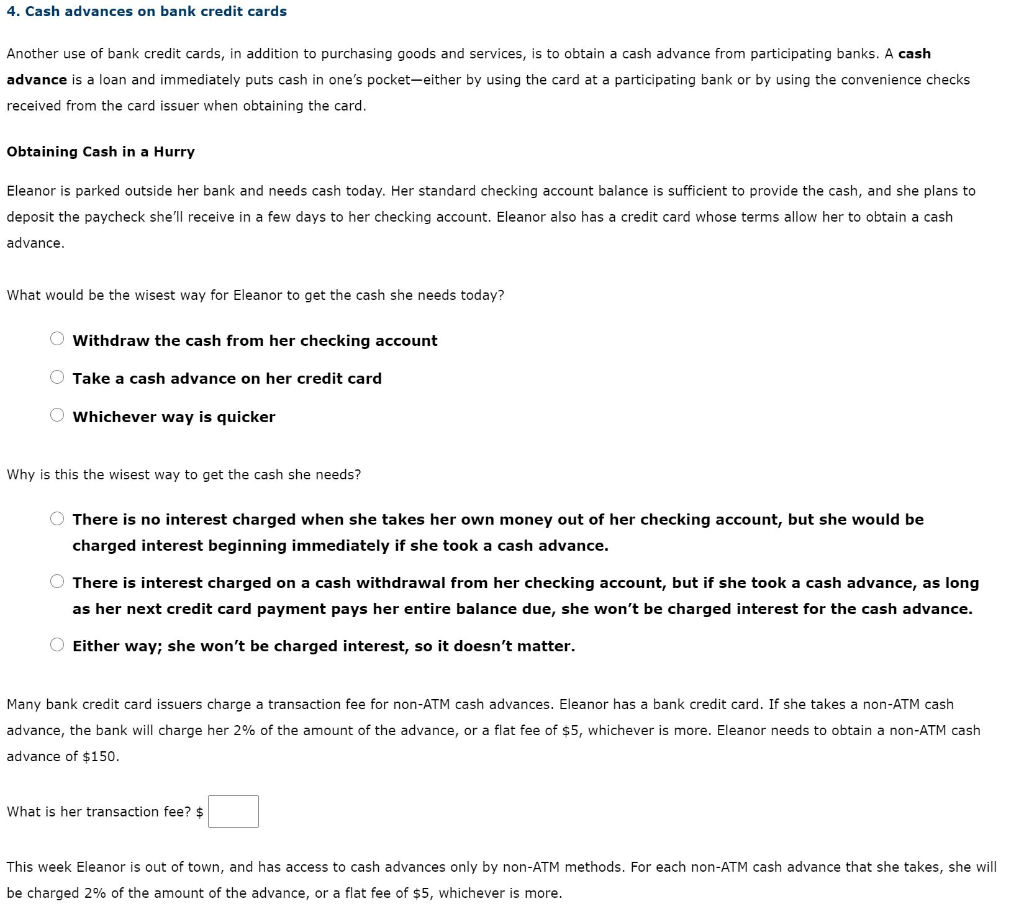

Median homebuyers will in all probability enjoys that loan equilibrium in the the latest $3 hundred,000 variety. In this case, at the 7.5% to the a not too long ago established loan, desire might cost regarding $20,000.

Which number, in itself, won’t meet or exceed the quality deduction getting a married few. It could meet or exceed the product quality deduction for an individual that has processing yourself, but not.

How do you see for certain?

These scenarios are created to give you an idea just how much the homebuyers pay during the focus. Bear in mind the true matter your paid in appeal are book for your requirements.

Fortunately: It’s not hard to understand. Just look at your 1098 form from the lender. If you pay your own homeloan payment online, you could potentially probably select the function in your account.

In the event the amount your paid-in notice exceeds their important deduction, you could spend less by the writing away from the desire costs.

Discuss with a tax elite

Because of the the characteristics, taxation law is challenging, specially when you start itemizing your own write-offs. In the event the loan places Thorsby attract rarely exceeds their practical deduction, you will possibly not save your self adequate to justify the excess some time costs away from itemizing.

Naturally, whether your attention is just one of a lot write-offs, evaluate their joint deductions to the practical deduction to see if it is worthwhile so you’re able to itemize.