Latest profile on monetary press strongly recommend a lot more homeowners was bringing out bridging financing so as that a buy can be go-ahead just before they provides ended up selling their existing property. An insufficient supply when you look at the needed-once towns made some consumers reluctant to get rid of property that they really want.If you’re promoting your residence and buying another, might constantly try to finish the two deals back-to-back. You’ll be able to utilize the earnings from your own sale to fund your purchase, and there’s essentially a cycle regarding interdependent purchases in which for every visitors, except the only towards the bottom of one’s chain, is dependent on offering their own assets ahead of they are able to go ahead.Taking that loan, which will help your connection the pit ranging from obtaining your household and soon after completing the latest marketing of your old you to, can allow you to secure you buy no matter one waits for the brand new strings if not when it collapses. But you’ll very own a couple of attributes to own an occasion and there is threats you need to imagine and must consult with your solicitor,’ says Lyndsey Dull, a licensed Conveyancer about House cluster that have Bailey Smailes.

If you intend to purchase a special possessions just before selling your household, this may features income tax ramifications. There are certain reliefs, getting financing progress income tax and inheritance taxation intentions, and that apply to your dominant private house. Having two qualities change exactly how these reliefs use and you’ll talk about the effects along with your elite group advisers.Also, it p obligations land tax on your own purchase. Because you will very own one or more possessions, you will have to shell out stamp obligation land-tax at the an effective higher level. Discover supply having a refund if you offer your dated domestic within this 36 months. However, you will need to make sure you meet most of the conditions and you may factor it into your preparations.

Because works by themselves of the income, it may be an alternative to agreeing a delay end or needing to look for another type of client in the event your chain collapses. It is also suitable if you wish to flow fast, such as when selecting during the auction. Simultaneously, bridging fund is designed for certain types of property whenever a normal financial is not.But not, there are also cons. In the end, while your capability to locate a home loan all depends Bokeelia loans through to your money, so you can qualify for a bridging mortgage you need to satisfy a loan provider you have got enough property, including which have adequate equity on your own existing assets.

If that goes, question how you will pay-off the mortgage

There have been two kind of connecting financing: closed’ where you will have a predetermined end day, such as for example if you have exchanged agreements in your income and you may are searching for fund to tide your more than until you found the completion monies; or open’ and no repaired stop go out since you have zero certainty over just when you should be able to pay it off, even though the financial will assume repayment within one year.

You ought to talk about your role together with your conveyancer. For example, if you intend to use the new arises from the selling of your property, it is vital to just remember that , until you change agreements their potential people you will change the minds. After you’ve exchanged agreements, your own customers was legally obliged to do towards the arranged end go out. In spite of this, the plan is not totally risk-free and you will, if you opt to go-ahead that have a bridging financing, we might strongly recommend extra means of mitigating chance.

You’ll be able to want to consider selection according to state, including a postponed otherwise conditional achievement day, borrowing off loved ones, remortgaging your current property, collateral release, attempting to sell assets, or having fun with part of the your retirement.When you’re to shop for out-of a designer, they may also be ready to undertake your property for the area replace.What exactly is right for you will depend up on your personal affairs. Since your solicitor, its our very own top priority to ensure you are aware your options and you can dangers in it.

A bridging finance bank will always take a fee over your own established assets as cover. If you fail to pay the mortgage, it means you might clean out your property. Which have a good repayment bundle is vital.Bridging financing concerns even more products together with legal documentation try a little not the same as a conventional mortgage. For people who actually have home financing on your own existing assets, new bridging loan financial will need the next fees hence their home loan company will usually have to agree to.It is very important explore good conveyancing solicitor with experience in this place. This can verify conclusion of your own expected formalities straight away and you will maintain one of several benefits associated with connecting funds: speed.

You will find knowledge of every aspect from homes conveyancing, and additionally bridging money. A bridging financing might not be suitable for people, and we will always make you independent advice for the risks inside it. All you choose, we are going to help to keep their deal on course although something do not go completely in order to bundle.For further details about buying or selling your house, delight contact Lyndsey Dull in the Residential property team towards 01484 435543 otherwise current email address Bailey Smailes possess offices during the Huddersfield and you can Holmfirth, Western Yorkshire.

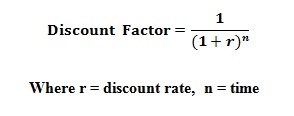

Basic, connecting financing usually are higher priced than just antique mortgages that have large interest levels and additional lay-upwards fees

This information is to have standard guidance simply and will not make-up legal or expert advice. Please note your law possess altered while the publication from the post.